Statesman

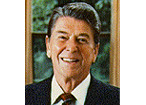

President Ronald Reagan on The 700 Club -- September, 1985

Pat interviews

President Ronald Reagan on The 700 Club.

PAT ROBERTSON: When the historians write about the Reagan administration, what do you want them to say?

PRESIDENT RONALD REAGAN: I've been asked that, and I guess I have to say I've never thought that far ahead. I'm so busy thinking about what we want to accomplish. I guess maybe just that I helped perpetuate this great American dream.

ROBERTSON: What do you hope for in the next three years?

REAGAN: I would like to get us definitely on the pattern of reducing the deficit so that the balanced budget is in view. I would like to have then going into effect a balanced budget amendment so we could never again go a half-a-century, as we have, of regular deficit spending each year. And I would like to see us also have some plan for beginning installments to start reducing the national debt.

|

Former President

Ronald Reagan |

There are a number of other things that I would like to see resolved, including the problem of prayer in schools. And to have us on the road, a good solid road that could make us optimistic about the chances for peace.

ROBERTSON: On the budget deficit, it seems as if members of your own party are not totally in accord with you. The Congress hasn't supported you. Are you optimistic?

REAGAN: Yes, I am. There's no way that anyone could ever balance the budget in one year. This debt, over the years, has been structurally built in to our budgeting process. And the difficulty, of course, is getting agreement, not on the need to reduce it, everyone seems to agree on that But then try getting them to agree on where to apply the tourniquet and shut off that hemorrhage of funds. But I think that we're on the beginning of a track where we can see progress in reducing the deficit as a percentage of gross national product.

If you just count the deficit in dollars, it looks so horrifying and you say, "How did this ever happen?" Well, if you look at it back over these 50 years of deficit spending on the basis of what it is as a percentage of gross national product, that, too, has been growing bigger. So it isn't as far out of line with past deficits. Some of them were just about as big as this one is in that percentage. What we have in mind is if we can get it next year down to 4 percent of the gross national product, 3 percent the following year, 2 percent the next year, we think that that progression will point us by 1990 to a balanced budget, and then you could have go into effect a balanced budget amendment.

ROBERTSON: I spoke to an influential Republican senator on Sunday who felt that possibly the tax reform measure might be diverting attention away from deficit reduction. Do you see that as a complement to it, or possibly, a stimulant for it?

REAGAN: Actually a stimulant for it. Because if you look back, not just in our administration and what we did in 1981 when we implemented or began implementing our tax cuts. But go back to President Kennedy's across-the-board tax cut. Before that to President Coolidge and the tax cuts that he implemented. In every instance, the economic growth has resulted in the government getting more revenues at the lower rates than it was getting at the higher rates. So I think this tax reform very definitely would help. It isn't aimed at that, but it would help in that it would stimulate economic growth, and I think would actually result in increased revenues.

ROBERTSON: This has been spoken of as a pro-family tax measure. How will that help the families in your estimation?

REAGAN: Well, let's start right off with someone down there at the lower end of the earning scale. One of the features of this is that the personal exemption is increased to $4,000, and then the deduction for dependents is almost doubled to $2,000 a piece instead of the present $1,040. So you take a family of four, you've got $8,000 of nontaxable income right there. And that plus the reduced rates … We believe that, and first of all, so many of our people can't and don't take advantage of many of the loopholes that others have been able to use to reduce their fair share of the tax burden.

So it is very definitely aimed at families, and that was sort of proven the other day when the Democratic majority in the House of Representatives, so I'm not just citing a Republican measure, in the Committee on Children, Youth and Family, had made a study of this tax proposal plus all the others that are before the Congress, and said flatly this one is the most pro family of all of the tax proposals.

ROBERTSON: Is the $2,000 personal exemption and dependent's exemption, is that a non-negotiable feature? Would you veto a bill if it didn't have that in it?

REAGAN: I think it just has to have it. And let me give you my thinking on that. Some years ago, as you know, that deduction was $600. And then inflation took hold and has kept coming on. And finally someone got around to increasing the $600 to $1,040. But right now, actually, if we had kept up with inflation, the deduction should be $2,700. Now we couldn't remain revenue neutral and go that high, but going to $2,000 is imminently justified, simply on the matter that actually in purchasing power that's smaller than the $600 was back in 1948.

ROBERTSON: There's no lobby for it, though, among the people, the vast numbers it will help. So will you, in a sense, be their champion and go to the mat on that issue?

REAGAN: Oh, yes. I have to say, though, that I haven't heard from Democrats or Republicans any objection to those figures. There have been some of the loopholes or deductions in other areas that people have thought should be retained, and there's been argument about that, but I haven't heard anyone raise a complaint about these personal exemptions.

ROBERTSON: One oblique question. I read that the reason that you and Franklin Roosevelt were so tremendously popular is because you gave the American people hope. Looking down the road, what cause do you have for hope?

REAGAN: Well, I'm an eternal optimist, I know. But, I can't help but have hope. Just a few years ago we were seeing our streets torn up with rioting and demonstrations of various kinds, but we also were seeing a lack of hope. We were hearing talk about that we were no longer a nation of growth and so forth. That we must begin to limit ourselves in our expectations. And our government itself was telling that to the people.

Here today in these few short years, double-digit inflation is down to less than 4 percent and still on its way down. The prime rate had reached 21.5 percent, and it is down to less than a half of that now, and still I believe rates are going down. In the last 33 months we have created 8 million new jobs. The highest percentage of the labor pool is employed now than has ever been employed before in our history. And the growth and the recovery have been the greatest that we have known in any recovery from any previous recession or depression.

But even more than that, there is something out there, you get out on the road and talk to the people, there is a spirit, our young people who once were totally disillusioned with government and so forth over the Vietnam War, the resurgence of patriotism among them. And now with our volunteer military, no longer having to have a draft, I don't know of anything I'm more proud of than our young men and women in uniform and their spirit.

ROBERTSON: I ask you a question for the women viewers in our audience. You've just gone through a very critical medical problem, and we know how close you and your wife Nancy are, it's almost a fabled love affair, better than Hollywood could do it, what was her reaction? How did she handle this crisis?

REAGAN: Well, she is very courageous. And once upon a time, when much younger, she was a nurse's aide. But she also is a very great worrier, and let me put this way, I've recovered quicker than she did.

ROBERTSON: Well, it was a terrible crisis. This is the second one. Some of your very close friends from California have gone back into private enterprise, or gone back home, are you turning more to your wife for counsel? She's a very wise lady.

REAGAN: We've always talked over everything together. I couldn't imagine it being otherwise. But as to the people leaving the administration, I've expected that. I had eight years' experience in California. And I made it plain from the beginning that these people, I would take them, even if it was only for a year or two years, and then find someone else if they, and when they had to return to their own careers.

And I think it should be that way. I wanted people in government that didn't really want a job in government, but that were willing to come and serve rather than those who were seeking government jobs. And the result is that they will have to go back to their own careers sooner or later. But, no, Nancy and I, we don't have any secrets from each other.

ROBERTSON: Mr. President, thank you so much. This has been wonderful. God bless you.

REAGAN: Well, thank you very much, and in saying that, let me tell you when you asked about the future and why I was optimistic, I am convinced this is a nation under God. And as long as we recognize that and believe that, I think He'll help us.

ROBERTSON: There's no question about it. That's the greatest cause for optimism I know of. Thank you very much, sir.

REAGAN: Thank you.

I can do all things through Christ who strengthens me.

—Philippians 4:13

—Philippians 4:13

© PatRobertson.com